Central cities are not likely to regain their former population. However, some of them may have reached an important inflection point—population growth has returned to at least some of the largest (and longest-declining) cities. For example, New York City’s population has increased by more than one million since 1990, after declining by about one million between 1950 and 1980. Over the past decade, nine of the ten largest (and 17 of the 20 largest) cities in the United States have gained population.

Many observers attribute the population turnaround to changes in the residential attractiveness of the city, although cause and effect are blurry since new residents themselves have instigated many changes to the urban landscape. Prominent urban researchers have described particular features of urban areas that have attracted households back to the core. These features include new housing in city centers, amenities such as specialized restaurants and night life, restoration of architectural gems, and myriad cultural activities. Such features are enticing increasing numbers of (mostly young) college-educated singles to call city centers home.

If one goes back in time, studies on urban household location tended to focus on the tradeoff in the cost of commuting from suburban areas and the lower price of land and housing in suburban communities. Research indicated that about half of the suburbanization in the post-World War II period was driven by higher income that increased the demand for suburban housing relative to city housing. It is still the case that suburbanization is partly driven by the demand for larger, detached houses that are more prevalent in suburban communities.

To be sure, amenities alone do not explain recent trends. Other studies have documented the ability of urban cores to foster jobs and businesses characterized by intense information exchange and creativity, thereby attracting college-educated workers to live in nearby neighborhoods. In a recent study, we show that central cities are an increasingly important work site for the most highly educated workers in all of the metropolitan areas that we examined, even bankrupt Detroit.¹

Income, education, and human capital are all important elements in city revival. In a recent study, Alan Ehrenhalt calls the return to city living the “great inversion” that reverses trends present in cities since the mid-twentieth century. He hypothesizes that some American metropolitan areas are beginning to resemble nineteenth century European cities, where the more affluent lived in city centers and households of more modest means lived in the suburbs. Some of the reasons that he offers for the heightened attractiveness of many central cities as a place to live are the decline of manufacturing in cities (making them more livable); lower crime rates; growth in the single, never-married population; lower fertility rates; and a bulging cohort of relatively affluent and educated seniors.

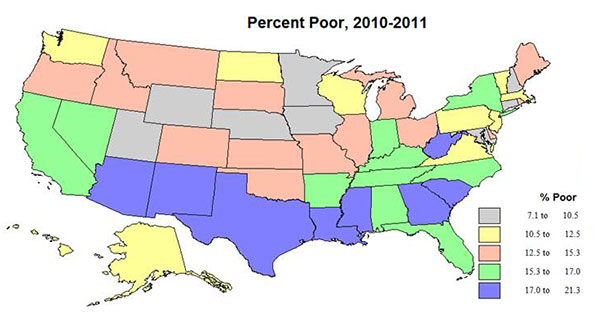

Although many cities still have a disproportionately number of the poor, poverty has become more suburban over the past decade. For example, the number of poor in suburbs of Chicago about doubled over the past decade. Thus, although the poverty rate in cities such as Chicago remains much higher, it has declined relative to suburban areas.

Conspicuously absent from recent discussion is the role and attractiveness of central cities for families with children. In the past, research and observation both indicated that suburbs provided families with cheaper land and housing, as well as safer neighborhoods and higher quality schools.

In many MSAs, the central city’s share of college-educated adults approaches or exceeds the city’s share of all persons aged 25 and older, with the exception of some older industrial cities, such as Detroit, Milwaukee and Philadelphia (see table). But for educated adults with children, only Seattle and Charlotte buck the trend, or come close to it.

Percent of MSA residents aged 25 years and older living in central cities, 2009

All Persons Age 25+ |

All College- Educated |

Parents with School-Age Kids | College-Educated Parents with School-Age Kids | |

Baltimore | 17 | 14 | 17 | 6 |

Boston | 19 | 20 | 13 | 8 |

Charlotte | 31 | 38 | 28 | 33 |

Chicago | 30 | 30 | 27 | 16 |

Cincinnati | 13 | 16 | 9 | 7 |

Detroit | 22 | 12 | 24 | 9 |

Milwaukee | 25 | 19 | 27 | 11 |

Minneapolis | 19 | 22 | 16 | 13 |

NYC | 49 | 46 | 47 | 36 |

Philadelphia | 33 | 24 | 30 | 13 |

Pittsburgh | 12 | 14 | 8 | 8 |

Seattle | 24 | 33 | 14 | 21 |

St. Louis | 16 | 14 | 13 | 7 |

San Francisco | 22 | 27 | 14 | 12 |

Washington, D.C. | 14 | 16 | 8 | 5 |

| Source: American Community Survey 2009. | ||||

Yet today, central cities undoubtedly have more to offer households with children. Many cities have made significant strides in improving their public safety, or they have simply benefitted from general trends toward lower criminal activity. However, with regard to public education, it is unclear whether most cities have achieved much traction in this regard, though efforts towards these ends are widespread. In the case of the city of Chicago, more affluent and educated families with school-age children continue to migrate to suburban communities. This has resulted in a 16.5% decline in the school-age population in the city of Chicago over the past decade.

Urban school improvement initiatives range from a host of teacher pay-for-performance reforms, to “small schools” reconfiguration, to charter school choice and high-achieving academies. In some instances, where highly educated parents with children have chosen to live in the city, parents have opted out of the public school system. For example, in Manhattan about 1 in 4 school-age children attend private schools. In the more affluent areas within Manhattan the percentage is much higher — about 1 in 2 children in families that live in either the Upper East Side or Upper West Side.

As they aim to encourage further population growth in city centers, policy leaders would do well to understand the residential choices being made by affluent and educated households with children and work to provide the amenities and services important to these families. They represent a population segment that may be significant in attracting jobs and building a tax base to provide public services for all city residents. Otherwise, working parents who must commute from suburb to city may demand higher wages as compensation for the additional time and cost of getting to work, thus having a negative effect on employment and investment in the city.

The recent influx of young (mostly well-educated) adult singles represents an opportunity for central cities. These urban homesteaders begin with a preference for urban living; policymakers might want to consider ways to keep them in the city as they marry and raise children.

In a current study, we are exploring the relationship between higher education, income, and the location of families with school-age children within a city-suburban area context for 15 large metropolitan areas in the United States, including Chicago, New York City, Philadelphia, and San Francisco.² In particular, we highlight the effects of various levels of higher education on household location and how education effects vary for different types of households. We compare our results with estimates for married respondents without school-age children and for never-married respondents without school-age children. Thus, we are able to highlight the heterogeneity in the effects of education on household location by household type and city-suburb location.

A key variable in our study is whether adults have at least a bachelor’s degree. In about half of the metropolitan areas we examine, educational attainment levels of householders are higher in central cities than in suburban areas. In some cases, the differences are relatively large—for example, the share of population with a college degree is 15 percentage points higher in the city of Seattle than in the suburbs. However, the share is 18 percentage points higher in the suburbs of Detroit than in the city.

But when it comes to college-educated parents, the apparent residential advantage of the city mostly evaporates. In most cases, college-educated parents with school-age children are far less concentrated in central cities relative to all parents with school-age children, with the exceptions of Charlotte, Pittsburgh, and Seattle. For example, 30 percent of college graduates in the Chicago MSA live in the city of Chicago, but only 16 percent of college-educated parents with school-age children live in the city. About half of these parents send their children to private schools.

On the face of it, the key reason that parents live in central cities is the location of their work. A high percentage of parents who work in central cities also live there. For example, 59 percent of parents with school-age children who work in the city of Chicago also live there. This declines to 43 percent for college-educated parents with school-age kids.

How do these numbers hold up to closer statistical scrutiny? To put them to the test, we conducted multivariate analyses with respect to individual household location in city versus suburb. We analyzed each of 15 city-suburb MSA pairs separately for the very recent past. Our study data are drawn from the Census Bureau’s American Community Survey for 2009. According to our results, the ongoing migration of educated, mostly young, adults into the city has not carried over into their child-raising years. Our findings are negative for higher education and income effects on living in a central city for families with school-age children for the largest cities within metropolitan areas in our sample, including Chicago, New York City, and Philadelphia. This contrasts with more positive higher education effects on living in cities for married and never-married respondents without school-age children.

In most of our study MSAs, households with high educational attainment lead the way in living in central cities, but the presence of school-age children negates this effect. Overall, having either a bachelor’s degree or a master’s degree has a negative effect on families with school-age kids living in a city, although there are a few cases where the effect is positive. Having very high levels of educational attainment (a professional degree or a Ph.D.) is negatively associated with living in a city only in a few cases, suggesting that parents with the highest levels of educational attainment tend to have a greater preference for living in cities than other college-educated parents.

To what extent should cities pursue households with children as a focus of strategic development? Clearly, the benefits of good schools and safe neighborhoods accrue to all population segments, so these are important goals for policy in any case. Social returns to education and safety are high; today’s children are tomorrow’s citizenry and work force. Now that more college-educated households are choosing to live in the city during their pre-child-raising years, city leaders may want to explore ways to entice more of them to remain in the city after they become parents.

William Sander (Ph.D., Cornell University) is professor of economics at DePaul University in Chicago. He has also taught at the University of Illinois at Urbana-Champaign and the University of the Philippines.

William A. Testa (Ph.D., Ohio State University) is Vice President and Director of Regional Programs, Federal Reserve Bank of Chicago. He has also taught at Tulane University.

References:

¹William Sander and William A. Testa. 2013a. “Education and the Location of Work: A Continued Economic Role for Central Cities.” Annals of Regional Science.

²William Sander and William A. Testa. 2013b. “Parents’ Education, School-Age Children, and Household Location in American Cities.” Paper prepared for the European Regional Science Association Congress, Palermo, Italy.

Crossing the street photo by Bigstock.