The Canadian Mortgage and Housing Corporation (CMHC) has issued a “red warning” for the entire housing market in Canada.” According to CMHC the red warnings are due to “strong evidence of problematic conditions for Canada overall. Home prices have risen ahead of economic fundamentals such as personal disposable income and population growth. This has resulted in overvaluation in many Canadian housing markets.”

This pattern has been present in Canada for at least a decade. This was the subject of a policy report authored by Ailin He, a PhD candidate in economics at McGill University (Montréal) and me (Canada’s Middle-Income Housing Affordability Crisis), which was published by the Frontier Centre for Public Policy in Winnipeg. The report covered all census 33 metropolitan areas and two smaller census agglomerations.

The Executive Summary (adapted) and selected charts from Canada’s Middle-Income Housing Affordability Crisis are reproduced below.

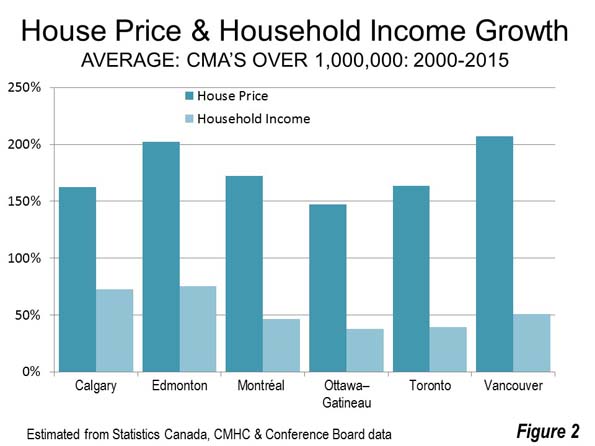

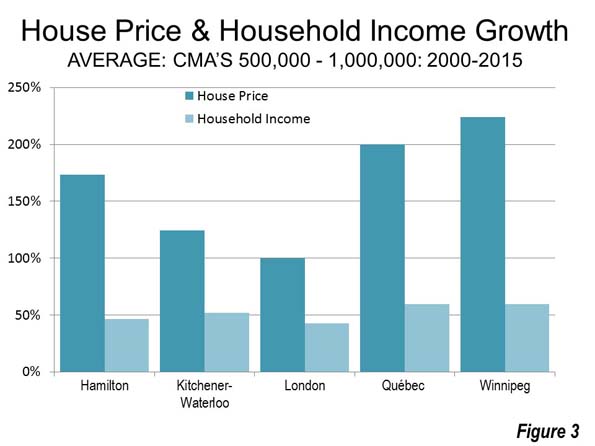

Canada has a serious middle-income housing affordability crisis. Canada’s house prices have grown nearly three times that of household income since 2000. This contrasts with the stability between growth in house prices and household income during the previous three decades. These house-price increases have raised serious concerns at the Bank of Canada and at international financial organizations such as the Organisation for Economic Co-operation and Development (OECD) and the International Monetary Fund (IMF).

This public policy report examines overall housing affordability in 35 housing markets, including all 33 CMAs and two census agglomerations (Section 1).

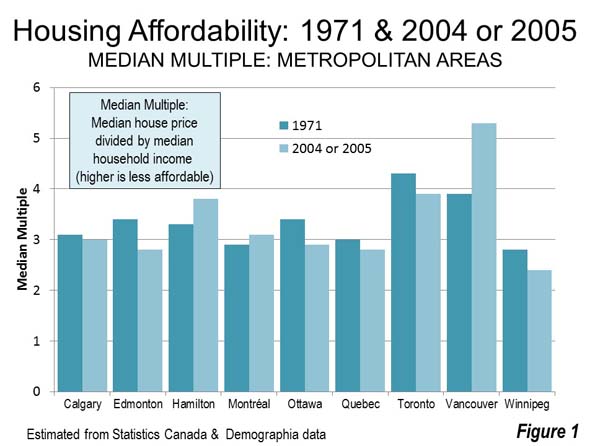

Higher house prices reduce the standard of living and constrain economic growth. Housing affordability is analyzed using indicators with comparisons between housing markets and within individual housing markets over time. Price-to-income multiples are used. Higher house prices mean less home buyer discretionary income (the amount left over after paying for necessities such as housing, food, clothing and transportation). Households have less income available for purchasing other goods and services, which can constrain economic growth and job creation. Moreover, less discretionary income translates into lower standards of living (Sections 1.1 and 1.2).

There was serious deterioration in middle-income housing between 2000 and 2015.This analysis shows that house prices rose faster than income in each of the 35 markets. The largest losses in housing affordability occurred in the six markets with a population of more than one million (Calgary, Edmonton, Montréal, Ottawa-Gatineau, Toronto and Vancouver), where house prices rose on average 3.3 times that of household income. More alarmingly, house prices rose more than four times household income in Vancouver and Toronto. In the five metropolitan areas with between 500,000 and one million residents (Hamilton, Kitchener-Waterloo, London, Québec and Winnipeg), house prices rose 3.2 times that of household income. Even in the smaller markets, house prices rose on average by at least double that of household income (Section 2).

Substantial mortgage affordability losses could occur with the expected interest increases. Should mortgage interest rates rise by 2020 as projected by The Conference Board of Canada, approximately 800,000 fewer households will be able to qualify for a mortgage on an average-priced house, all else being equal. This could have an impact sooner than expected, since many Canadian mortgages require renewing every five years (Section 3).

Higher house prices have made it more difficult for middle-income households to afford the housing that Canadians have preferred for decades. Higher house prices appear to have been a principal factor in a trend toward smaller houses and condominiums across Canada between 2001 and 2011. This shift is most evident in Vancouver and Toronto, where housing markets also have the most-restrictive land-use regulation (Section 4).

Restrictive land-use policy is associated with housing affordability losses. International economic literature associates more-restrictive land-use regulation with diminished housing affordability. The largest housing affordability losses have occurred in metropolitan areas (markets) that have adopted urban containment land-use strategies, which severely limit the land that can be used for building houses on and beyond the urban fringe. Consistent with basic economics, this reduction of land supply is associated with rising land prices, which lead to higher house prices. Without the substantial reform of restrictive land-use policies, housing affordability is likely to continue deteriorating (Section 5).

Higher house prices impose adverse social and economic consequences. Higher house prices are associated with increased rates of internal migration out of higher-cost markets, increased inequality, overcrowding, the greater public expenditure that is required to support low-income housing and losses to the economy (Section 6).

Solving the middle-income housing affordability crisis will require policy reforms. There is considerable evidence that restrictive land-use policies are associated with significant losses in housing affordability in Canada as is the case elsewhere. Metropolitan areas with restrictive land-use policy should undertake reforms aimed at improving housing affordability. There should be a moratorium on the adoption of urban containment policy where it is not yet in place. Concerns have been expressed about the potential for high house prices and high household debt to complicate the ability of central banks (such as the Bank of Canada) to perform their monetary policy responsibilities. Conclusion: that middle-income housing affordability in Canada is a profound social and economic crisis that warrants serious and concentrated public policy attention (Section 7).

Wendell Cox is principal of Demographia, an international public policy and demographics firm. He is a Senior Fellow of the Center for Opportunity Urbanism (US), Senior Fellow for Housing Affordability and Municipal Policy for the Frontier Centre for Public Policy (Canada), and a member of the Board of Advisors of the Center for Demographics and Policy at Chapman University (California). He is co-author of the "Demographia International Housing Affordability Survey" and author of "Demographia World Urban Areas" and "War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life." He was appointed to three terms on the Los Angeles County Transportation Commission, where he served with the leading city and county leadership as the only non-elected member. He served as a visiting professor at the Conservatoire National des Arts et Metiers, a national university in Paris.

Photograph: Calgary (by author)