The prospect of a purple and eventually blue Texas thrills progressives who see the Lone Star State as the key to their drive for post-Trump domination. Before draining their champagne glasses and filling their bongs, the coastal crowd should sober up enough to consider what happens if the Texas miracle comes to an end.

Many Republicans, meantime, have come to consider Texas their sovereign territory, a deeply conservative place where even Democrats were generally pro-business and growth was the prevailing religion. This last election ended what remained of that hallucination. In virtually every big metro—the increasingly dominant geography of Texas—the Democrats grabbed control.

In the election for Senate, the uniquely unattractive Ted Cruz lost the 25 largest counties to his challenger, media darling Beto O’Rourke, by a combined 700,000 votes. Only the hard-right remnants of small-town Texas allowed Cruz to claw out a narrow victory. Due in part to slate voting, large counties also turned control over to Democrats, as in Harris County, the home of Houston, which is now led by 27-year-old -progressive Lina Hidalgo, a 27-year-old part-time student with almost no work experience.

Several factors seem to be driving this change, including a growing population shift to large metropolitan areas, a diversifying economy and, most of all, rising migration both from abroad and from the rest of the country. This changing electorate—younger, more ethnically diverse, better educated—has shifted the state’s politics away from a Republican Party operating under the shadow of Donald Trump and his fellow travelers.

“What is our message? “asks Austin-based GOP consultant Kevin Shuvalov. “What do we stand for? Republicans don’t seem to care about anyone. This is not a winning strategy.”

Over the past two decades, Texas has enjoyed one of the greatest economic expansions in recent American history. In contrast to notions of a wide-open Texas defined by oil rigs and cattle, this expansion has been a profoundly urban one. Approximately 80% of all population growth since 2000 has been in the four large metropolitan areas: People may wear cowboy boots, drive pickups and attend the big Rodeo in Houston, but, they are, first and foremost, part of a great urban experiment.

Economic growth has driven this process. Since 1969, Texas has considerably out-performed California in terms of percentage job growth, as well as real personal income growth. Between 2000 and 2016, according to the Bureau of Labor Statistics, or BLS, Austin expanded its employment by over 50 percent, while Houston, Dallas and San Antonio grew above 30 percent, more than twice the growth of New York and three time that of San Francisco and Los Angeles.

As cities like New York, San Francisco and Los Angeles become too expensive for most millennials without trust funds to put down roots, young people are now flocking to Dallas or Houston. These new Texas urbanites are forging an increasingly vibrant design, arts and restaurant scene. They are also, on average, better educated than the average Texan, and they elevate the workforce, notes Dallas Morning News columnist Mitchell Schnurman.“If oil prices don’t go up,” he says, “Texas can always count on California—and New York, Florida, Illinois and New Jersey“ to export their talent.

Ironically, the arrival of these newcomers is changing the policy environment that created the conditions for this migration. Partly, this reflects a change in funding. Democrats of the old school, like Houston’s former Mayors Bob Lanier and Bill White, raised money from the real estate industry and other interests that also supported the GOP. The new Democratic crowd relies on massive funding from the post-industrial progressive gentry, much of it concentrated in traditional Republican-leaning areas: The fanciest areas around Dallas and Houston at election time sported many more Beto than Cruz signs. The big money, notes Shuvalov, now, as in the nation, goes to the Democrats.

O’Rourke helped drive this trend and benefited massively from it. Unlike many traditional Texas Democrats, O’Rourke ran as a standard-brand national progressive, earning him an almost embarrassing degree of adoration. The lanky El Paso Congressman is already being compared to Lincoln, counselled by President Obama and widely seen as a serious contender for the Presidency, despite what even The New York Times notes is “an absence of signature policy feats.”

At the local level, many new Democratic office-holders such as Hidalgo will likely adopt very much the national party agenda, with its emphasis on dense urbanization, climate change and racial “equity.” She has already announced that she will campaign against “sprawl,” which literally defines Houston, greater spending on trains, which have done very poorly in the area, and an agenda focused primarily on transfers to the poor. Add to that the Democratic Party’s climate-change mantra, including provisions to eliminate fossil fuels by 2030 and forbidding energy executives from serving in the White House, and you have a scenario that could devastate an economy still built largely on oil and gas.

The rest of America should care if Texas abandons its model. Without it, we will increasingly resemble European countries—like France—where all power and wealth is concentrated in the largest, densest and most established cities, while everyone else is on the outside looking in. And the country will have lost its premier safety valve for young people and families priced out of the coasts.

Unlike many New Yorkers or San Franciscans, most Texas city-dwellers are not forced to choose between having a family, with a middle-class lifestyle, and staying in a city they love. The large Texas cities, according to American Community Survey data, all rank above the national average in children per household, while New York and San Francisco sit near the bottom.

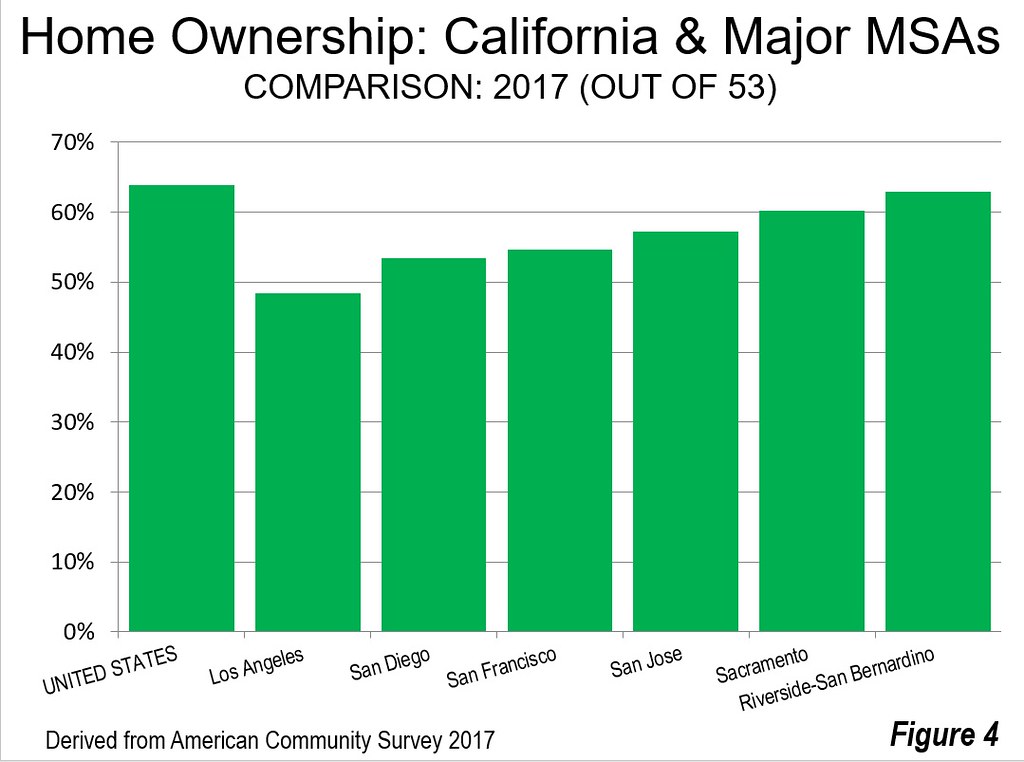

The new Texans might not like Ted Cruz (who does?) but one wonders if they would welcome a policy regime like that in California, where the middle and working classes are confronted with an ever more feudalized reality.

America can endure, and even thrive, with a New York or a California to service the rich and employ their servants. But it also needs a place for upward mobility and the chance to buy a house. If Texas stops providing that, we may be running out of dynamic states where the less than affluent can achieve their aspirations. America needs a Texas that is still Texas, not a big, flat, dry place trying and failing to impersonate San Francisco.

Texas was a place of opportunity even when it was part of Mexico as bankrupts, criminals and others looking for a fresh start headed there from the old southeastern states, leaving behind the note: “Gone to Texas.” But for most of the 20th Century, the Lone Star trailed the Golden one, with its advanced industry, perfect climate and spectacular topography, a fallback for those who no longer could afford, or find opportunity, in New York.

Today California suffers net outmigration, massive property inflation and arguably the country’s worst regulatory environment. Now it’s Texas where people are flocking; the state added 3 million people between 2010 and 2016—including 940,000 migrants from other states. In comparison, California lost more than 500,000 domestic migrants to other states and New York hemorrhaged nearly one million.

Texas now increasingly represents the urban future. Since 2000 Dallas-Ft. Worth has boosted its population by 33.6 percent, while Houston has gained 38 percent. New York, Chicago, Los Angeles and Boston grew by well under 10 percent. Austin and San Antonio, not to mention the burgeoning region between these two cities, gained people even faster.

Many of the newcomers come from places—notably California—that many Texans once migrated to. On average, in each of the past five years, more than 25,000 people left California for Texas.

Between 2000 and 2014, the Latino population grew by 39 percent in Dallas-Fort Worth, 39 percent in San Antonio, 42 percent in Houston, and by 60 percent in Austin. In contrast, Latino population growth slowed down to 8 percent in Los Angeles, 7 percent in San Francisco, 6 percent in New York and 5 percent in Chicago.

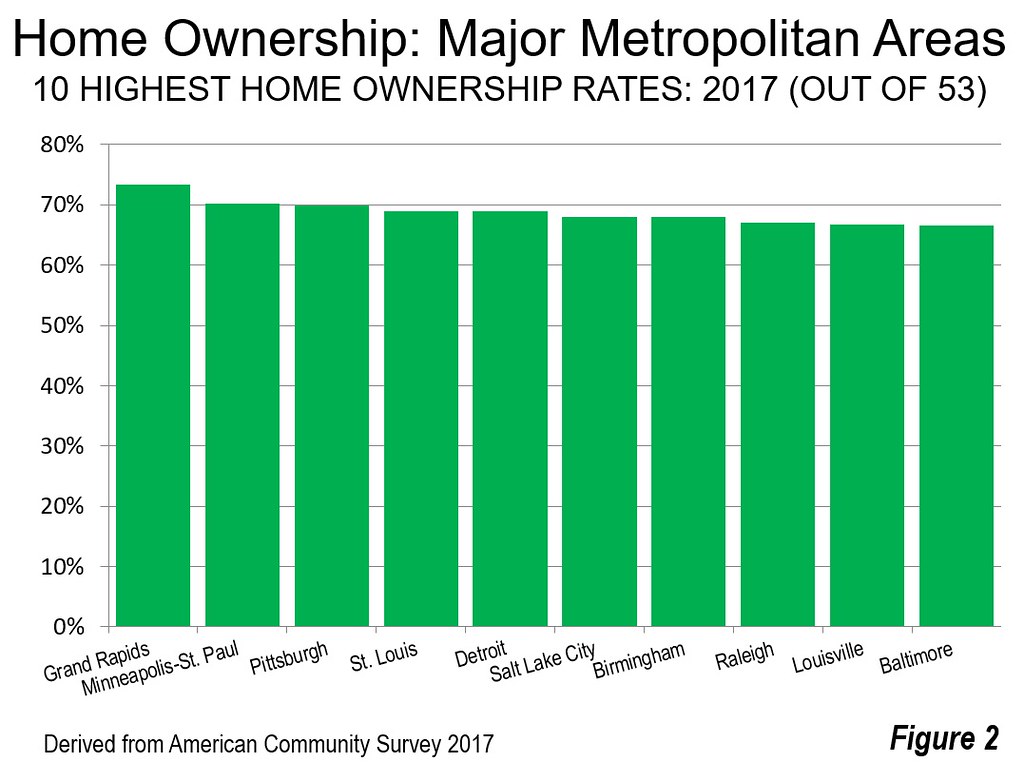

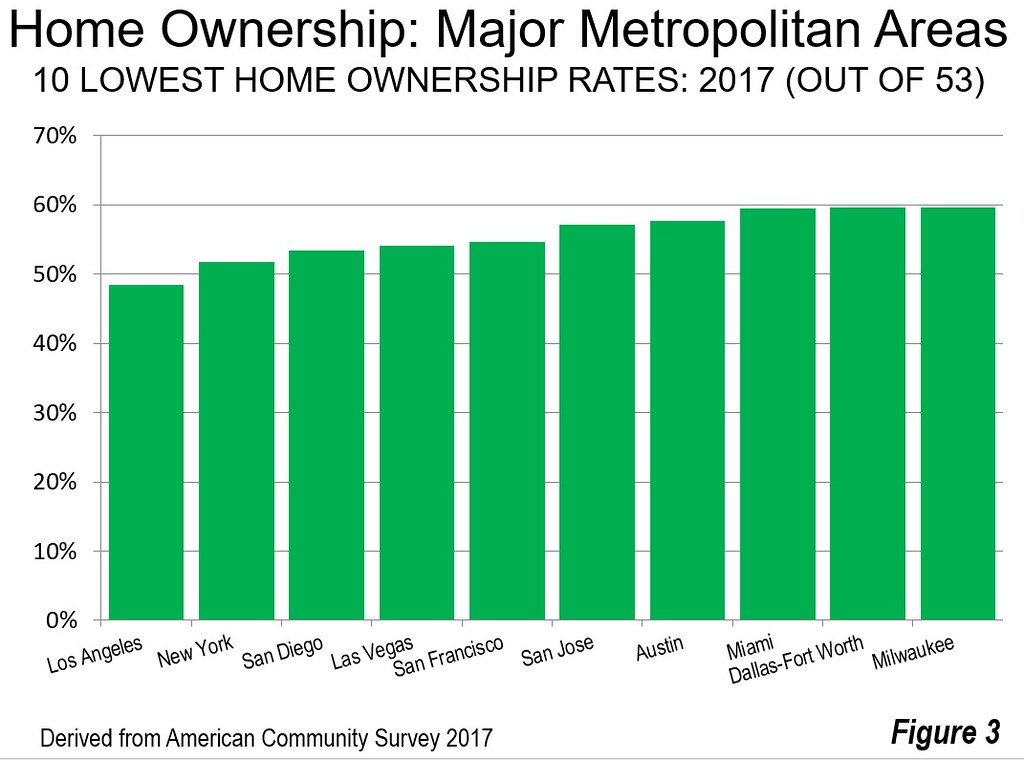

Economic opportunity explains much of the gap. The vibrant industrial and construction culture of Texas has provided many opportunities for upwardly mobile Latinos. Texas cities made up 17 of the 50 best ones for Latino entrepreneurs, by one recent measure. Boston, New York, Los Angeles and San Francisco didn’t make the top 100. More than 50 percent of Latinos in Dallas-Fort Worth and Houston own their own homes; fewer than one in four does in New York, Boston, San Francisco or Los Angeles. African Americans also do better in Texas, but by not so wide a margin.

In Texas, minorities have tended to focus on economic opportunity as key to their future. “The consensus in San Antonio,” notes former Mayor and Clinton HUD Secretary Henry Cisneros, “is all about jobs. Everything is driven by that. The idea of inclusiveness for Latinos may have started a political dialogue but now everything is focused on business and opportunity. People get along because we have the same goals.”

No one suggests Texas has been a total success at integration. Poverty levels for both blacks and Hispanics are high in inner-city Houston, Dallas-Fort Worth and San Antonio, although lower housing prices help; education levels also lag in inner-city and predominantly minority areas. Yet overall, according to Richard Florida’s “urban crisis index,” which measures such things as inequality in the 20 largest metros, Los Angeles, New York and San Francisco ranked worst while Houston and Dallas ranked 11th and 12th. The big difference is that the poor and working class there have a decent chance to achieve a middle-income lifestyle, unlike in the ultra-expensive coastal states.

Nor is growth in Texas all at the low end, as some, like Paul Krugman, have insisted. Over the past 15 years, according to the BLS, the Texas cities have experienced faster growth in STEM (Science, Technology, Engineering, and Math)-related jobs than their more celebrated rivals. Austin and San Antonio have grown their STEM-related jobs more quickly than the Bay Area, while both Houston and Dallas have STEM employment at almost twice the national average, well ahead of New York, Los Angeles, and Chicago.

Texas cities have also enjoyed faster growth in middle-class jobs, defined as those paying between 80-200 percent of the national median wage. Since 2001, these jobs have grown 39 percent in Austin, 26 percent in Houston, and 21 percent in Dallas, a much more rapid pace than in San Francisco, New York or Los Angeles. Chicago has actually lost such jobs. In critical blue-collar fields like manufacturing, New York has lost jobs since 2010, while Texas has boosted its numbers by over 7 percent, twice the rate of California.

For a few years after 2010, California could boast of exceeding Texas job growth, largely due to a weakening in oil prices and the tech boom. But now the Lone State is again greatly exceeding its coastal rivals. This year, Texas is growing its GDP at almost twice the rate of California or New York. Its personal income growth, up 6 percent in the first quarter of 2018, was the highest in the nation.

Much of the credit goes to the state’s reputation for business friendliness. Texas consistently ranks as the first or second leading locale as ranked by business executives. The tax burden has remained far lower than in New York, California, Connecticut, New Jersey, and Illinois. This explains a huge wave of corporate relocations ranging from Occidental Petroleum to Jacobs Engineering, Bechtel and, most recently, Foremost McKesson, the sixth largest firm in terms of revenue on the Fortune 500. Apple just announced a major expansion in Austin, now its second largest base in the US.

A reversal of the policies that have driven Texas’ ascendancy would be a tragedy, not just for the Lone Star State, but the nation as a whole. America needs Texas, just as it once needed New York, Chicago and Los Angeles, to serve as a beacon of opportunity and a place for people to create the second acts that have shaped our civilization.

This piece originally appeared on The Daily Beast.

Joel Kotkin is executive editor of NewGeography.com. He is the Roger Hobbs Distinguished Fellow in Urban Studies at Chapman University and executive director of the Houston-based Center for Opportunity Urbanism. His newest book is The Human City: Urbanism for the rest of us. He is also author of The New Class Conflict, The City: A Global History, and The Next Hundred Million: America in 2050. He lives in Orange County, CA.

Photo Credit: Another Believer [CC BY-SA 3.0], from Wikimedia Commons

![]()